(A data driven process to identify cost saving opportunities)

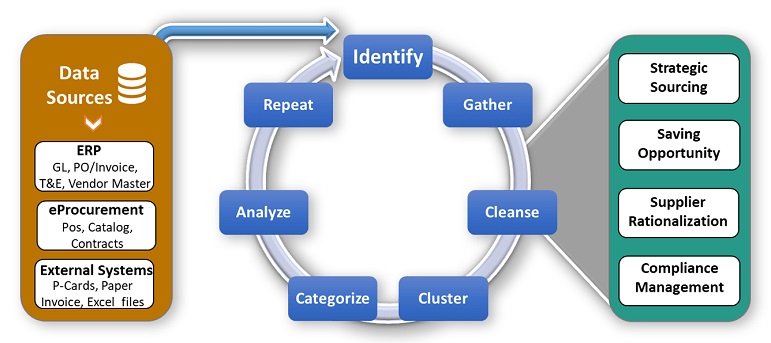

There's a phrase, "you don't know what you don't know". Organization without Spend Analysis won't know what and where they are spending, which can ultimately leads to less visibility of real savings on overall and on category level. Availability of Spend Visibility & Analysis allows to make better decision making at all levels of the organization. A real data-driven Spend Analysis leverages more capabilities and effective savings opportunities at a lesser cost and in some cases, uncovering opportunities in just a few commodities can save millions of revenue. This shows the real power of spend analysis process.

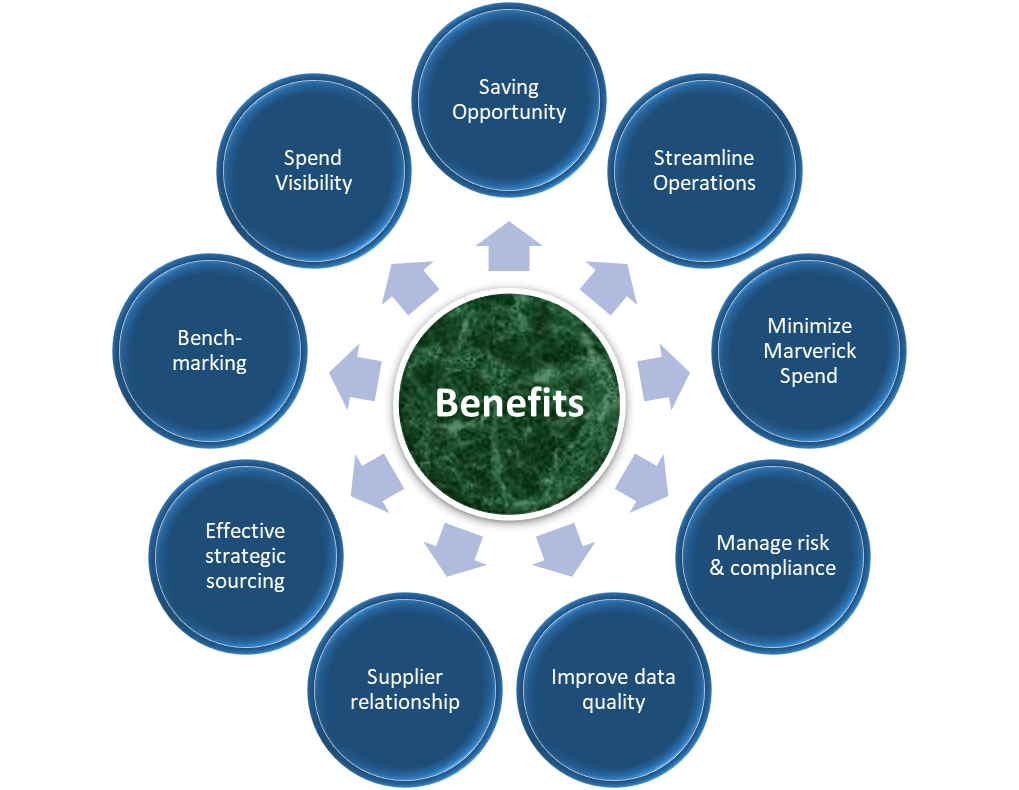

Spend analysis process leverage a number of effective benefits to procurement organizations like:

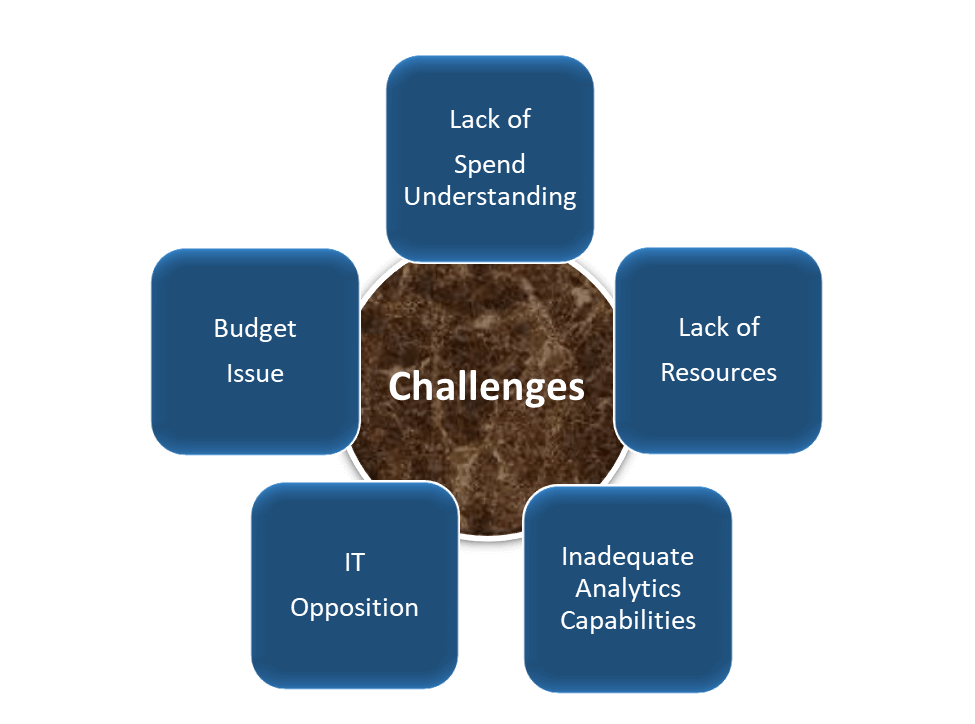

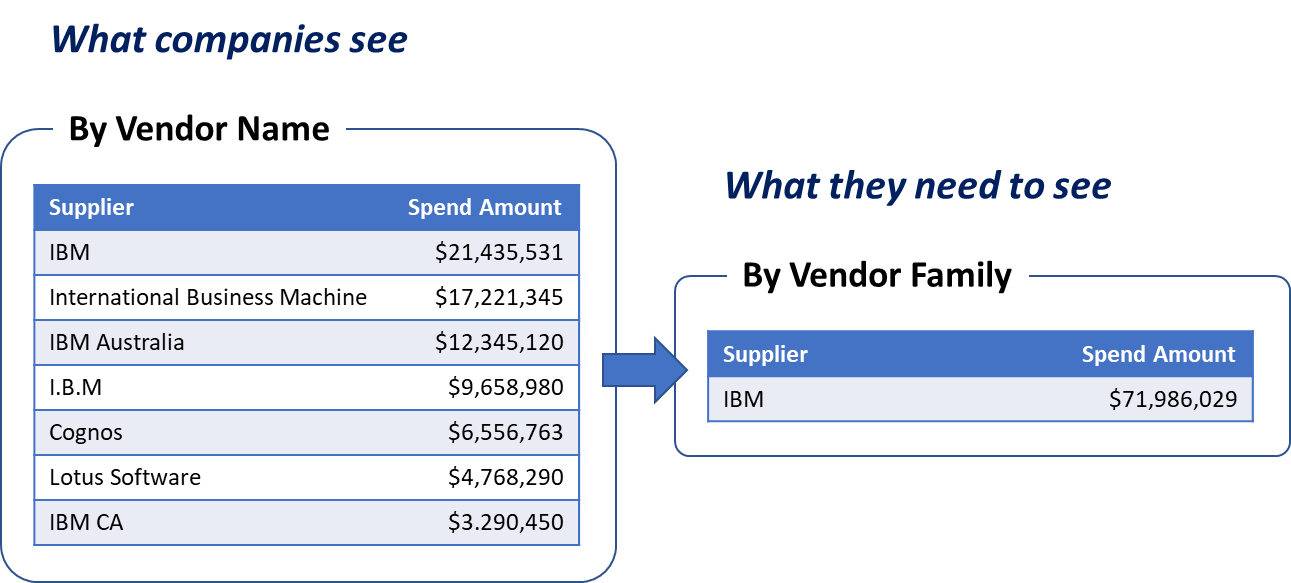

The current economic environment is forcing companies to prioritize and implement cost cutting programs faster than before. Useful data is increasingly "in the weeds" – as companies pick all the low hanging savings fruit. To achieve new results it becomes necessary to go below the data surface to look at the lowest level of the transaction, payment or related information. Other challenges include:

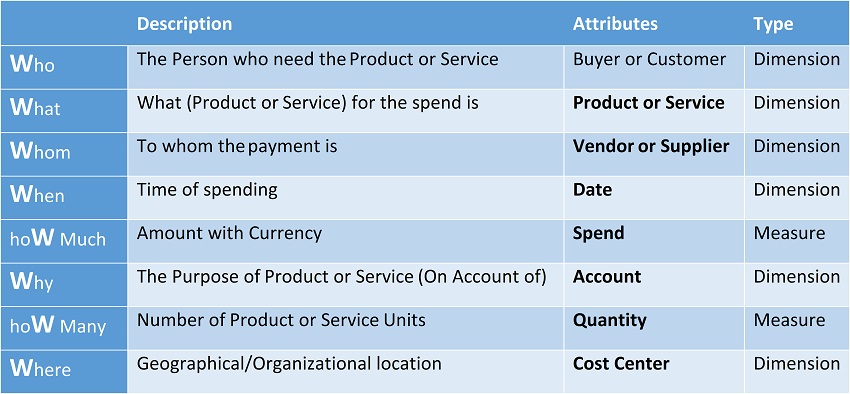

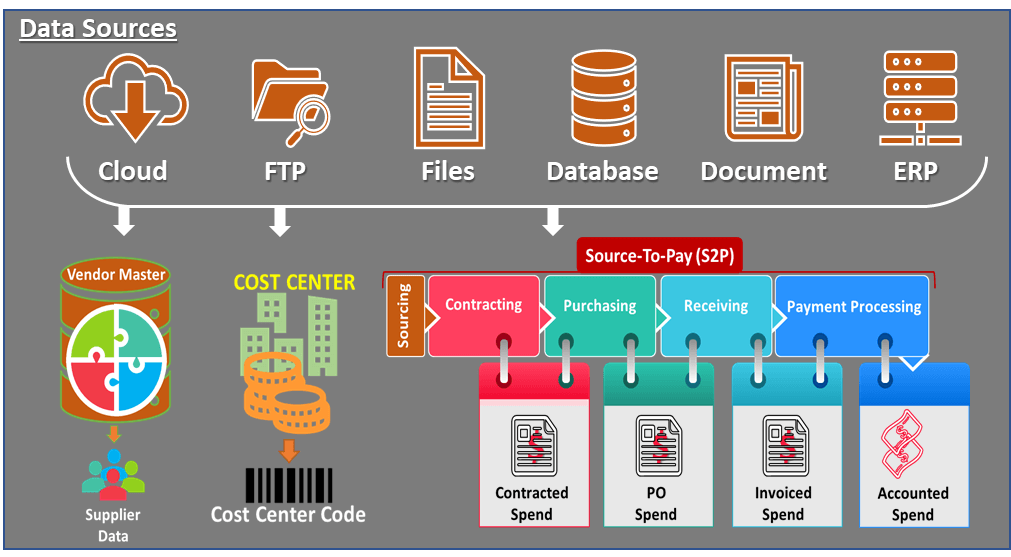

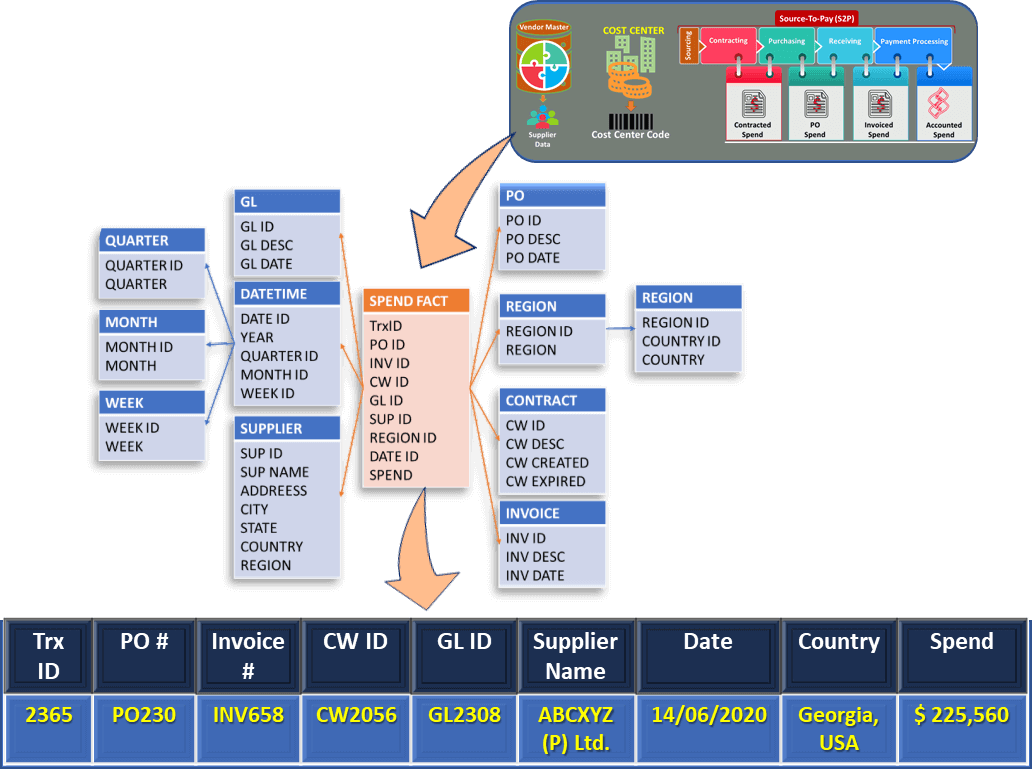

Spend represent the organization’s expense or expenditure on staff costs as well as the purchase of goods and services from external suppliers.

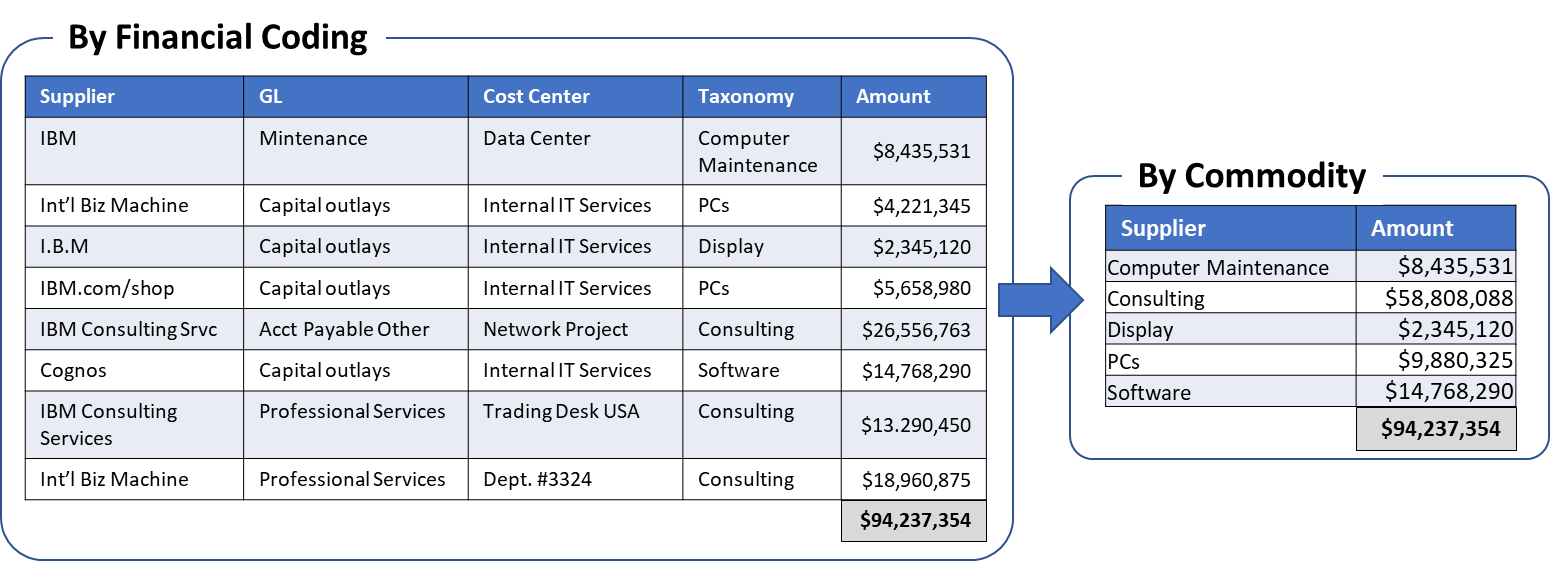

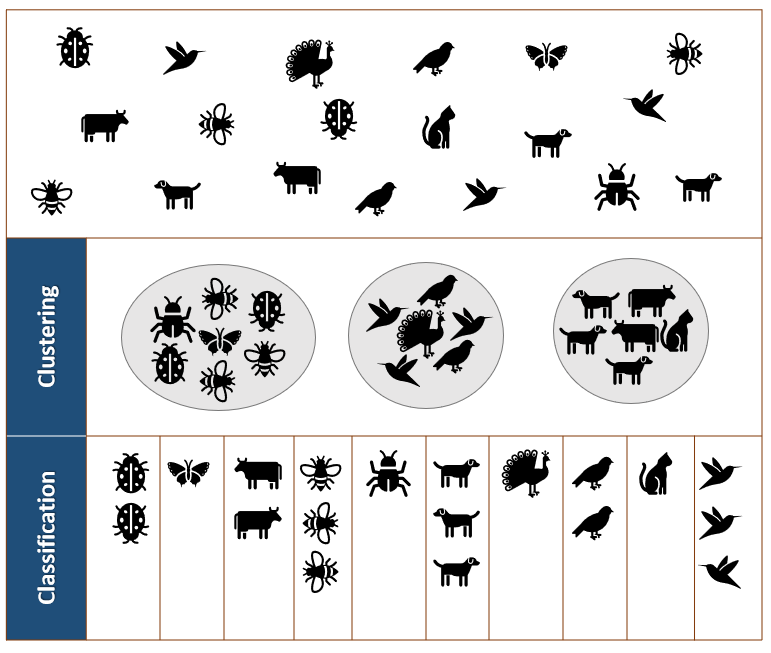

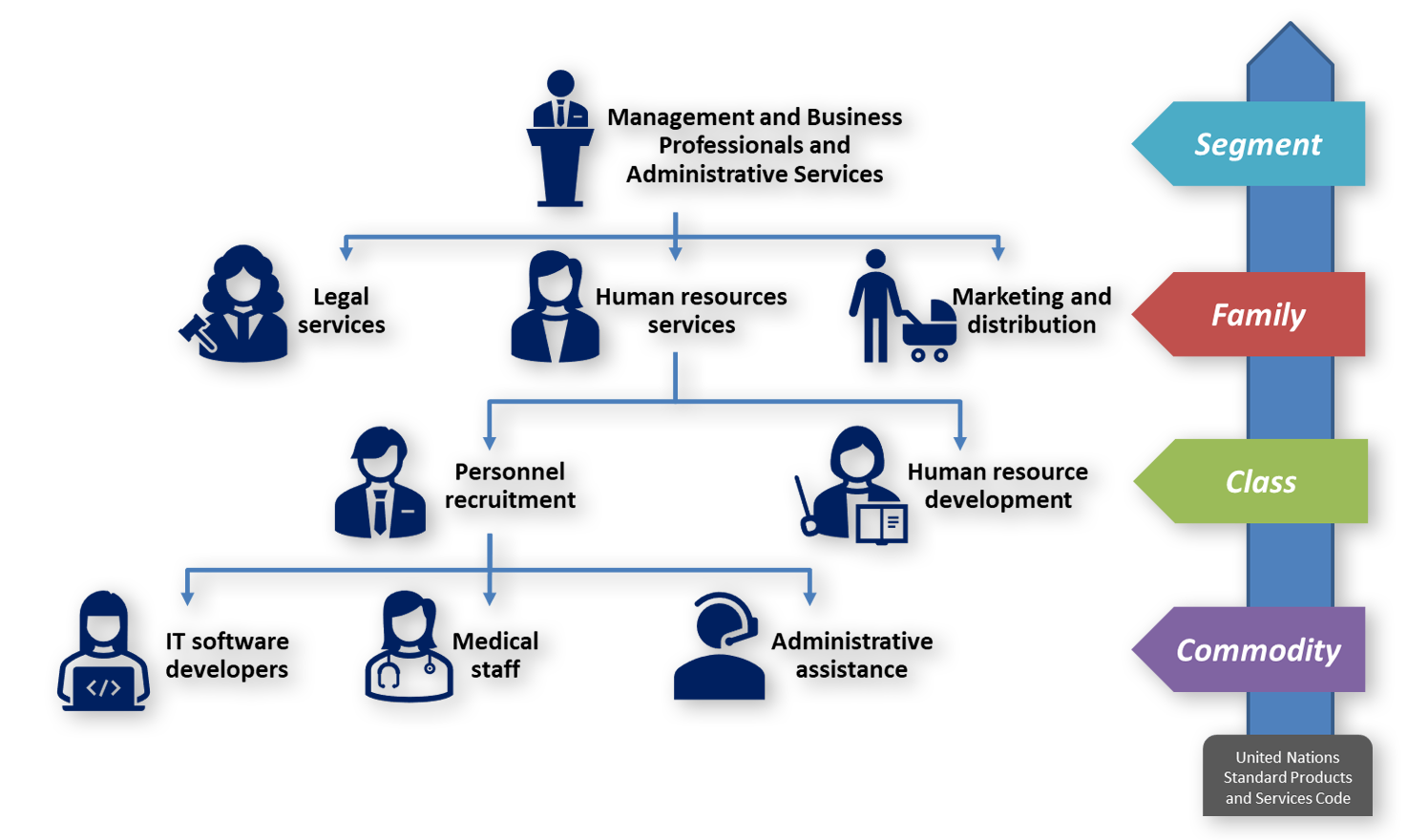

A spend category is the logical grouping of similar expenditure items or services that have been clearly defined on an organizational level. For example, “information technology” may be considered a spend category covering both IT software and hardware.

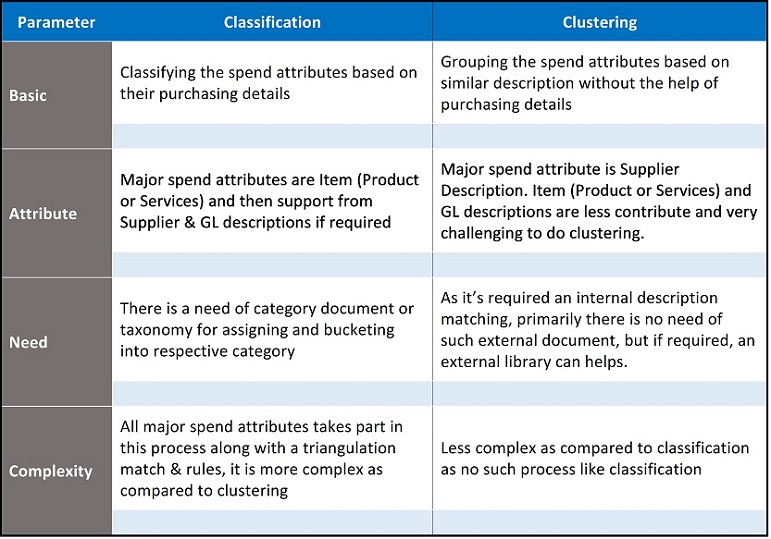

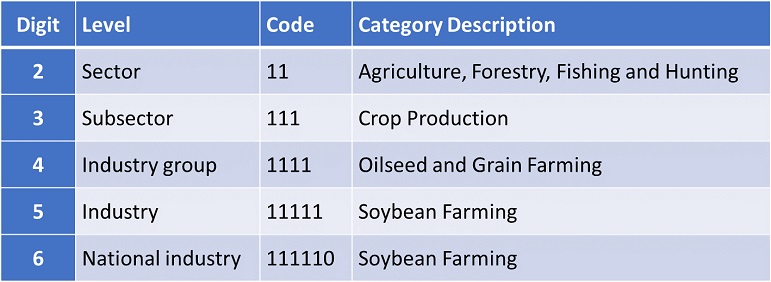

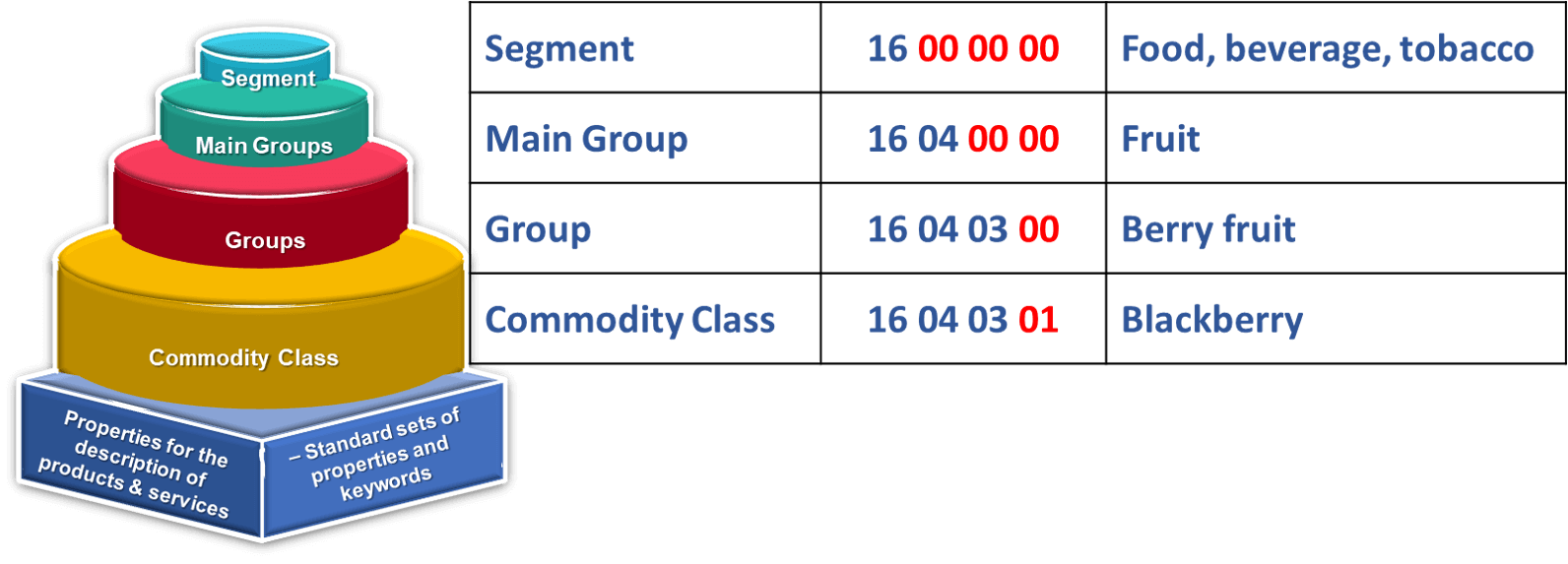

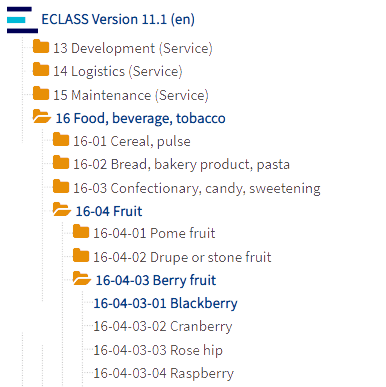

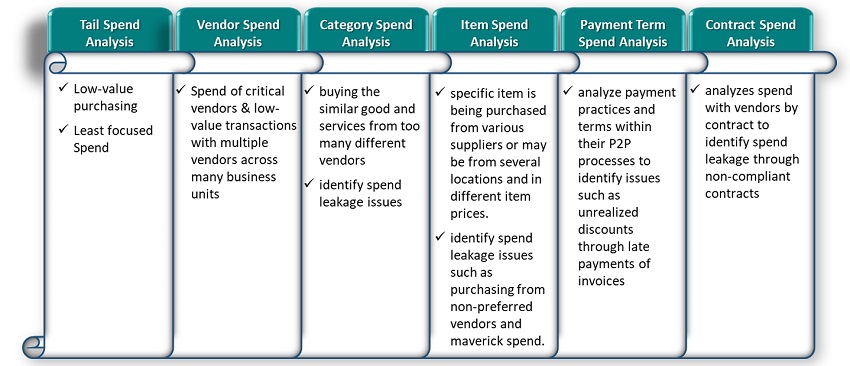

Spend taxonomy is the way a procurement organization classifies spend into hierarchies. So spend categories is like a tree with many branches for different levels or sub-categories of spend. The number of levels in a spend taxonomy depends on the organization’s needs and complexity of the spend, ranging from three to five levels of categories and sub-categories . Spend taxonomy can be standard one like UNSPSC, NAICS, SIC, ECLASS or custom one as per organization purchased categories.

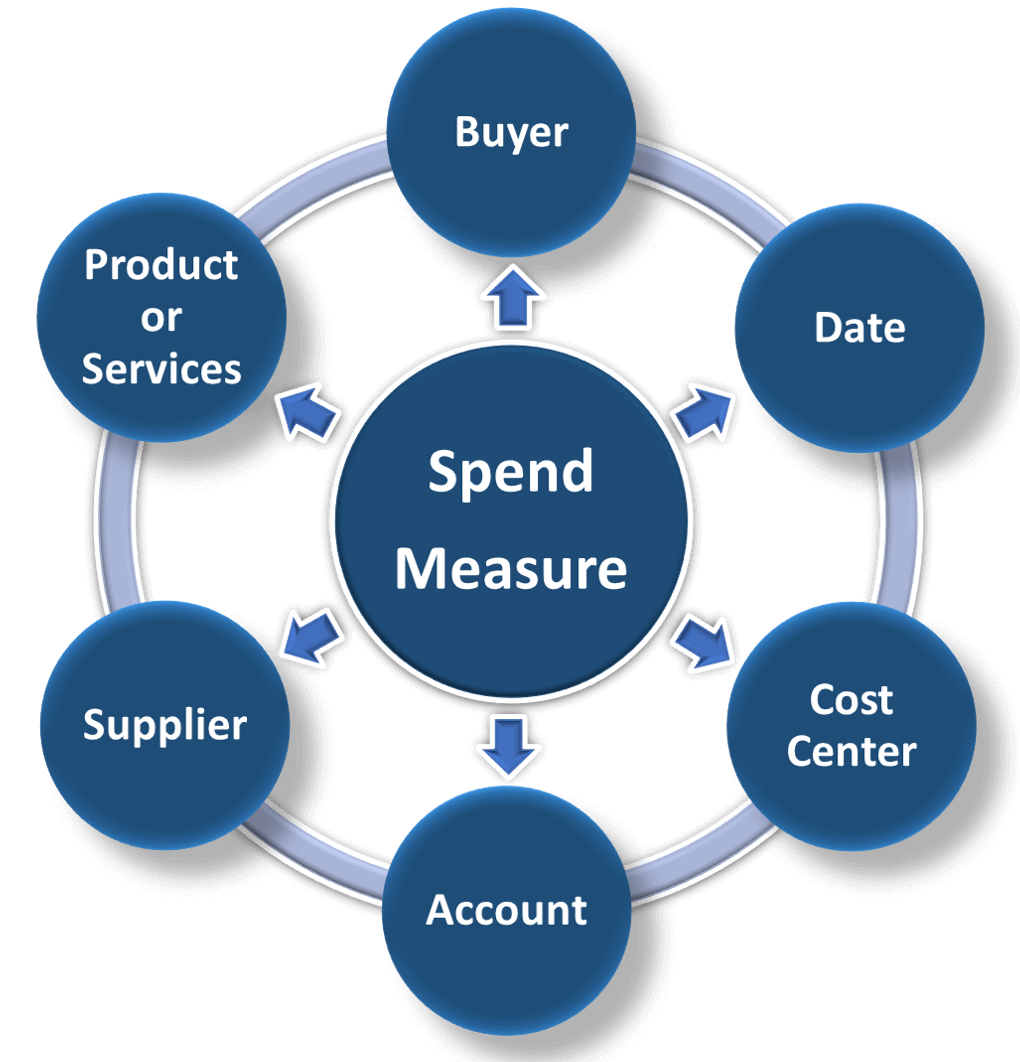

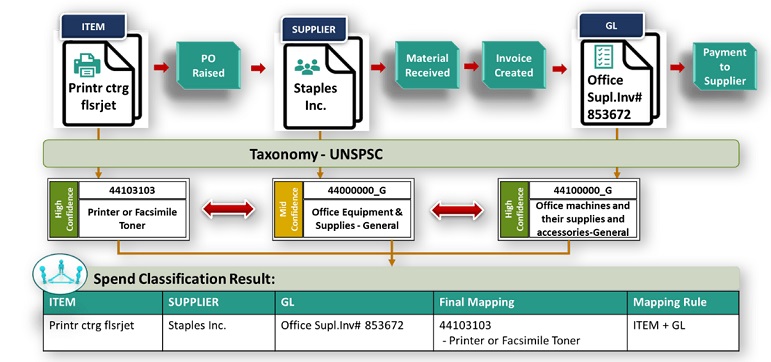

Procurement data can be sliced and diced based on a number of key performance indicators (KPIs) relevant to the procurement organization. Some of the most common spend analysis metrics or KPIs include:

Procurement leaders are keen to see effective spend reports and analytics for better business decisions and cost saving opportunities. Some of summary and top spend reports on highly effective spend attributes like:

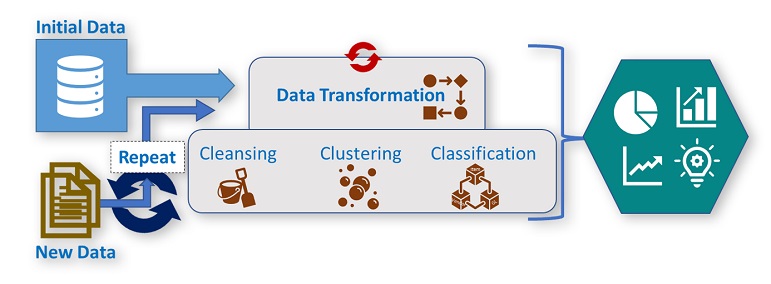

Analyzing organizational spend is easier said than done. It have a great capability for identifying and implementing cost reduction activities based on the analysis. Both technology and consulting plays a major role in the implementation of procurement spend solution, where it leverages to streamline the spend management process and assess the spend activity thoroughly with respective changes as needed. This will allow organization to manage the risks, ensure compliance, and maximizethe optimum profits.

In2In Globaldata transformation and Insights solution lets you gain full spend visibility and manage your company’s sourcing activities. Our highly experienced Spend Analysis data experts& SMEs make your life a bit easier by gathering your spend challenges and willprovide cost-effective pricing plans for our both online & offline procurement spend data transformation and management system. Get in touch with us to know more in details and give us an opportunity to serve you better.

Thank you for your valuable time to read the knowledgebase on spend analysis.

Let's talk about your data transformation and insights issues. Our highly skilled data analysts will look at your data challenges and offer cost-effective price plans on both automated platform & consulting approach. We'll show you how our solutions mitigate risk, guarantee compliance and optimize revenues from your transactional data.